Refund request support specialized for foreigners and non-residents

An international tax accountant specializing

in「non-resident refunds」will support your refund requests.

Claiming Sales Tax Refunds

When non-residents purchase real estate, sales tax (building purchase price×sales tax % ) is applied to the building price (purchase price excluding land price). However, it is possible to receive a refund on this sales tax by claiming a refund.

Points of caution when claiming Sales Tax Refunds

As submission of various documents to the tax bureau is necessary and only those who meet the requirements are applicable, we recommend consultation before making your real estate purchase.

A Quick Look at「Sales Tax Refund」

(Actual Case)Purchase of a JPY ¥400,000,000 (¥416,000,000 total) real estate

| Building | Sales Tax | JPY ¥200,000,000×8%=JPY ¥16,000,000 |

|---|---|---|

| Purchase Price JPY ¥400,000,000 |

JPY ¥200,000,000 | |

| Land | JPY ¥200,000,000 |

| Tax incl | Sales Tax | |

|---|---|---|

| Annual Rent Income | JPY ¥43,200,000 | +JPY ¥3,200,000 |

| Necessary Expenses (Including renovation fees) | JPY ¥21,600,000 | ▲JPY ¥1,600,000 |

| Sales tax on the building price | - | ▲JPY ¥16,000,000 |

| Net Refund Claim Amount | ▲JPY ¥14,400,000 | |

Let’s consult an international tax accountant regarding whether or not the case above has possibilities of a refund.

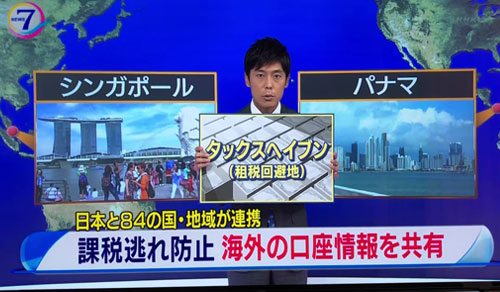

Foreigners residing overseas and Japanese citizens residing overseas are regarded as「non-residents」in Japanese tax laws, and are exempt from not only residency taxes but in some cases, also exempt or alleviated from income taxes due to utilization of the tax treaty.

Furthermore, in contrary to residents, income within Japan are withheld. Even after filing tax returns, it is possible to claim refund for tax withheld by requesting correction. In order to do so, it is important to understand the possibility and amount of refunds.

Free checkup・No mobilization fee

Please feel free to inquire to find out possibilities of refunds.

Inquiries from overseas are also welcome.

Flow from consultation to appointment of duties

We promise to be a helping hand to all who realize their eligibility to make refund requests.

-

STEP1

Consultation via E-mail・Application・Contract

-

STEP2

Send required documents

-

STEP3

Confirmation of documents, create refund invoice, apply

Confirmation of documents, create refund invoice, apply

-

STEP4

Receive your refund

Required documents・Mailing address

Please fill out the document below and send to the following address via email or post. We will contact you after receiving the documents.

【Required documents】

- All documents related to sale of real estate(sale purchase agreement, invoice/receipt of brokerage fees, registration fees, etc.)

- All documents related to purchase of real estate(sale purchase agreement, invoice/receipt of brokerage fees, registration fees, etc.)

- Copy of withholding tax payment slip ※Please acquire from buyer.

- Bank account information of account receiving refunds(Copy of cover and 1st page of passbook)

- Service Agreement ※Please fill in address, name, etc. and sign.

- Written notice of tax agent ※Please fill in address, name, etc. and sign.

※For those who filed for tax returns, please also prepare a copy of the tax return form and documents stating monthly balance of payments until sale.

【Mailing address】

Email:info@tax-refund.jpn.com

Address:Masayuki Tanabe

Tanabe International Tax & Accounting Firm

Palais Royale Nagatacho #706 2-9-8 Nagatacho Chiyoda-ku Tokyo 100-0014

Worried about expenses?Consultation is easy! Our 3 promises

In our hopes for everyone to「consult about their refunds without having to worry about compensation」, we have prepared「Consultation is easy! Our 3 promises」.

- Promise 1Prior consultation is free of charge

- Promise 2In the case, no refunds are made, compensation is free of charge

- Promise 3As the fee is a contingent fee,

no expenses are borne until refunds are received