Tax regulations regarding real estate investment of non-residents

Overview

| Real Estate Rent Income | Real Estate Transfer Income |

|---|---|

| Progressive Tax Rate 5~45% | Separate Taxation Long-term 15.315%、Short-term 30.63% |

| Withholding Tax:Rent Income×20.42% | Withholding Tax:Transfer Price×10.21% |

| In case where rental is for personal residential purpose: No withholding tax |

In case where transfer price is under 100,000,000JPY and for residential purpose: No withholding tax |

| Income Deduction:Basic deduction, refund deduction, casualty loss deduction only | |

| Residents’ Tax:Tax-exempt | |

Explanation 1Withholding tax of non-residents

In the case where a resident transfers real estate, there is no withholding tax. However, for non-residents, on the other hand, withholding tax is incurred. The only case where this withholding tax is exempt is in the case where the transfer price of the real estate is under 100,000,000JPY and the purchaser makes the purchase for the residential use of him or herself or its family.

In other words, if the real estate transfer price is over 100,000,000JPY, withholding tax will be incurred regardless of its mode of usage.

Furthermore, if purchased for the purpose of investment, withholding tax will be incurred. In either case, the withholding tax payer is the purchaser.

For example, in the case where the purchase price is 120,000,000JPY, a withholding tax of 10.21% is incurred and an amount of 12,252,000JPY is to be paid to the tax authorities by the 10th day of the following month.

Therefore, an amount, after withholding tax is deducted, of 107,748,000JPY (120,000,000JPY – 12,252,000JPY) is paid to the non-resident seller.

Explanation 2Taxation in residential country

In the case where taxation is incurred to the capital gain of the real estate in the residential country, tax amount may be adjusted by utilizing overseas tax amount exemption on the amount of tax withheld in Japan or the tax amount after refund requests are made.

Furthermore, in the case where the range of taxation in one’s residential country is limited to domestic income such as in Singapore, tax declaration and payment on capital gain in Japan is not necessary.

Countries Where Overseas Income is Exempt

Singapore, Malaysia, Thailand, Brunei, Macao, Hong Kong, Philippines, Taiwan, Fiji, Anguilla, Bahamas, Bermuda, Cayman, Guatemala, Costa Rica, Panama, UAE, Bahrain, Kuwait, Oman, Qatar, Saudi Arabia, etc.

Handling of Tax Treaty Signed by Japan

In the tax treaty signed by Japan, similar to the OECD Model Treaty, primary taxation right is given to the country of which the real estate is located, and profit due to real estate transfer in Japan is taxed according to the laws of Japan.

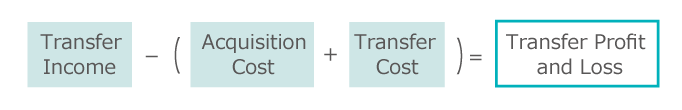

Calculation Method of Real Estate Transfer Income

Acquisition Cost

| Land | Purchase Fee or Estimate Acquisition Fee (5% of Transfer Price) |

|---|---|

| Building | ①Purchase Fee or Estimate Acquisition Fee (5% of Transfer Price) ②Unamortized Balance After Depreciation ③Purchase Price-Depreciation* *Purchase Price×0.9×Depreciation Rate×No. of Years Elapsed |

| Brokerage Fee | |

| Registration Fee | |

| Others | Stamp duties at the time of purchase, sales tax, Property tax prorated amount |

※An estimate acquisition fee may be used regardless of whether or not the purchase price is known or unknown.

Transfer Cost

- Brokerage Fee

- Sale Purchase Agreement Stamp Duties

- Advertisement, transportation fees, etc. at time of sale

- Appraisal, survey fees, etc.

Transfer Losses

Excluding a certain amount of transfer loss of residential asset, profit and loss may not be totaled with other income.

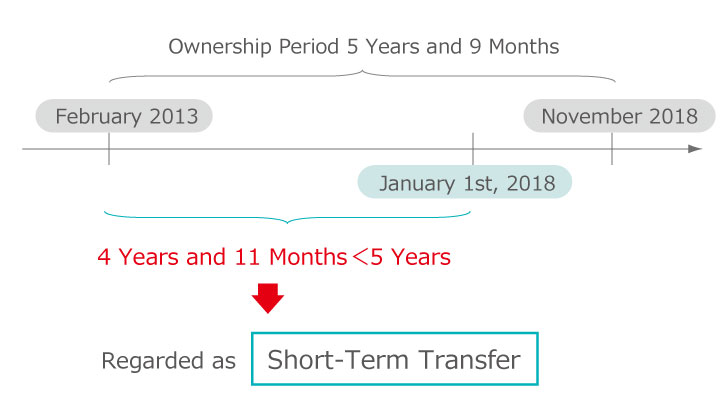

Judgement Between Long-Term and Short-Term

Judgement is made by calculating the length between the date of transfer when purchasing to the date of transfer when selling, but this may also be judged according to the date of the sale purchase contract.

| Long-Term Transfer Income | Ownership period of over 5 years from January 1st of the transfer year until today |

|---|---|

| Short-term Transfer Income | Ownership period of under 5 years from January 1st of the transfer year until today |

Example

In case of selling real estate purchased in February 2013 in November 2018